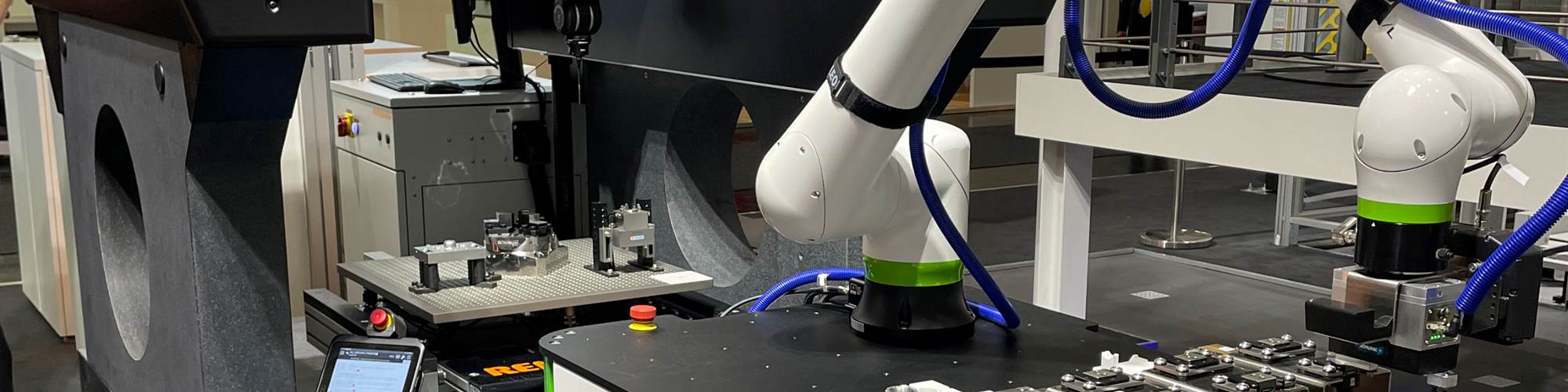

Manufacturers must automate and advance if they are to meet customer needs and create jobs. An online loan prequalification tool available through the Colorado Advanced Manufacturing Association can facilitate those efforts for companies in that state. (Photo credit: PM)

The Colorado Advanced Manufacturing Association (CAMA) has launched a no-fee digital platform that streamlines, simplifies and expedites access to capital for small manufacturers, supporting job growth and economic development in a challenging market environment.

The new loan prequalification tool, which is being piloted in Colorado before being introduced in other U.S. markets and industry sectors, was developed by Austin-based Access Capital Technologies, the digital arm of ACTCapital, a nonprofit organization serving community lenders and their small business and start-up clients nationwide.

Featured Content

Manufacturers must automate and advance if they are to meet customer needs and create jobs. However, financing new technologies amid rising interest rates is challenging. This new access-to-capital tool matches the manufacturer with the most suitable lender, taking time and guesswork out of the loan search process while enabling businesses to spend more time building their products.

Through our CAMA website, Colorado’s small manufacturers can access the user-friendly platform operated by ACTCapital. After answering a few essential questions, the program will match the manufacturer with the specific lending programs that will meet its needs. The manufacturer is in charge of the process and can select to which institutions it would like ACTCapital to refer its application. This process takes the guesswork out of the loan search process, enabling the manufacturer to spend more time building products.

FirstBank, Key Bank and DreamSpring are among the community lenders partnering with CAMA to launch the initiative, noting that the new tool assists their organizations in supporting Colorado’s smaller manufacturing businesses.

This new loan prequalification tool is being piloted in Colorado before being introduced in other U.S. markets.

One of CAMA’s trusted Banking Partners is FirstBank. Kristen Bernhardt, president of FirstBank’s Northwest Market and a CAMA board member, says the company knows that manufacturers are vital to the U.S. economy, but they often deal with workforce and capital challenges. “We look forward to helping them find solutions to efficiently operate and grow their business and see the access-to-capital program as one of several ways we’re able to accomplish that,” she explains.

Edmond Johnson, CMMA member and president and CEO of Premier Manufacturing, brings a new source of funding to Colorado manufacturers. Johnson is also the board chair of DreamSpring, one of the country’s top micro lenders. He believes the collaboration between CAMA and DreamSpring will result in many micro- and small-business manufacturers gaining access to capital — money they can use to advance technology-driven manufacturing in their facilities.

Luther Branham, co-founder and managing director of ACTCapital, says this new access-to-capital platform can cut costs for new customer loan origination by nearly 70% and reduce acquisition costs by half, while almost entirely eliminating application rejections. He notes that ATCCapital provides fast access to the best lending product, interest rates and terms through technology that is easily scalable across different organizations. “We’re launching the platform with CAMA and its lending partners and will be adding more industry sectors and programs that support small businesses as we grow, focusing on underserved and often overlooked markets and communities across the United States,” Branham explains.

This tool is an exciting first step in helping Colorado’s manufacturers digitize and transform their operations. Interest rates, however, will continue to make it difficult for manufacturers to borrow the funds to pay for these advancements. Recognizing this, CAMA is already working with ACTCapital to launch Phase Two of this access-to-capital tool. Phase Two, to be launched in early 2024, will include:

- An interest rate buydown program for CAMA members to make loans more affordable in a rising interest rate environment, and;

- A small grant program to help offset any upfront costs on loans.

Automation is no longer a luxury for the few. With the 4th industrial revolution, automation is necessary for even the smallest manufacturers. CAMA hopes this tool will keep manufacturers in Colorado, and eventually across the country, competitive and profitable well into the future.

About the Author

Tim Heaton

Tim Heaton is the President of Colorado Advanced Manufacturing Association.

RELATED CONTENT

-

Advanced Automation Answers Demands

How can we utilize automation in our facilities to create a better worker experience and increase throughput?

-

Automating Cutting Fluid Management

Automation can amplify the benefits of cutting fluid management while reducing the maintenance burden on shopfloor employees.

-

Pay Attention to These 7 Themes at TASC

Looking to automate your shop floor? The Automated Shop Conference (TASC) will connect shops with experts who can advise them through this transition.