EMO Hannover 2023 featured approximately 1,850 exhibitors with roughly 70% coming from 45 different countries. Show organizers say that more than half of the show visitors were attending for the first time. (Photo credits: PM)

This past September, I attended EMO Hannover, our industry’s largest global trade show. (Or fair, as they call them in Europe. Booths are referred to as stands there, too.)

It was the fourth EMO I attended in Hannover, Germany, another being in Milan, Italy. And, it was a bit different for me because I had been asked to write articles for the EMO Daily publication distributed at the show, much like I’ve done for the IMTS Show Daily going on two decades now.

Featured Content

The article topics assigned to me were largely based on press conferences presented in English. In all, I wrote six articles on site and learned about aspects of our industry that I otherwise might not have given how I’ve typically approached EMO events in the past. (I typically concentrate on booth visits as a means to learn about new equipment and technology being introduced at such shows.) However, I felt it worthy to provide a brief recap of five of those articles here.

Some Taiwanese machine tool builders such as YCM are refining smart manufacturing technology in their own production facilities before offering to customers.

-Machine tool builders should digitalize first. A panel discussion hosted by the Taiwan External Trade Development Council (TAITRA) pointed to a number of emerging markets the Taiwanese machine tool builders and cutting tool manufacturers are successfully supporting. These include semiconductor, electric vehicles and renewable energy.

During the discussion, Patrick Chen, chairman of the Taiwan Machine Tools and Accessory Builders’ Association (TMBA) and general manager of machine tool builder YCM, pointed to the importance of smart manufacturing practices to help support machine shops serving those and other industries.

Specifically, he mentioned the value of machine tool builders first implementing smart manufacturing concepts in the build of their equipment before offering that technology to customers.

“As part of digital transformation, I feel we machine tool builders have to implement these solutions within our factories first,” Chen says. “That enables customers to believe these solutions will work as they see it firsthand in our factories.” YCM, in particular, has worked with outside IoT company Advantech to develop an effective CNC management solution that works with YCM’s existing digital systems.

FANUC has sold 1 million robots to date. Cobots are growing in interest for various applications even beyond tending machine tools, the company says.

-FANUC focuses on three drivers for product development. For FANUC, a variety of considerations go into new endeavors and product development. Three current areas of focus based on machine tool industry trends include lack of skilled labor, energy cost and digitalization. Each presents unique challenges.

To help mitigate workforce problems, the company offers its FANUC Academy. European academies alone have trained more than 11,000 customer employees in multiple academy locations in fiscal year 2022/2023. Courses for robots and CNC include maintenance, programming and operation. Similar courses are also available relative to the company’s RoboDrill machining centers, RoboCut EDM machines and RoboShot injection molding machines. FANUC has also entered a global partnership with WorldSkills, organizing competitions for young people to help attract new talent to industry.

To combat rising energy costs, FANUC continues to develop products offering lower energy consumption. For example, the new FS500i-A series CNC which is currently in development offers an intuitive new human machine interface (HMI), digital twin technology, structured text programming and 10% reduced energy consumption, the company says.

In addition, artificial intelligence (AI) in the form of thermal displacement compensation is being used to reduce overall machine tool energy consumption by minimizing warm-up times.

FANUC is supporting the industry’s move to digitalization by applying concepts such as digital twin technology using virtual machines and machine components to optimize performance, streamline operations, test new concepts and reduce cost.

In addition, the company’s FIELD system (FANUC Intelligent Edge Link and Drive) is an IoT platform that enables manufacturers to connect production machines of different generations from all manufacturers to perform comprehensive data analysis along the entire process chain. Plus, an assisted reality app can enable remote customer support which could eliminate a visit from a FANUC technician.

Supporting customer needs remains a focus for this longstanding company, one that has sold 5 million CNCs, 1 million robots and 300,000 RoboDrills.

A new change in controlling ownership is set to breathe new life into Fidia, the nearly 50-year old Italian CNC and machine tool manufacturer.

-Fidia’s “new era” is underway. Next year marks the 50th anniversary of Fidia, the Italian producer of CNCs and machine tools. In 2021, Futuro all’Impresa purchased controlling interest in Fidia and Luigi Maniglio, senior partner at Futuro all’Impresa, was appointed Fidia’s executive chairman.

Maniglio points to three reasons for the purchase. The first is that Fidia has a long history of innovation, although he notes that this waned a bit over the few years before the purchase. The second is that Fidia has a large international footprint with six subsidiaries around the world, subsidiaries that he feels can be better leveraged to the company’s advantage. The third is that Fidia is a known brand in the CNC and machine tool markets.

Augusto Mignani, general manager, says the DL321 five-axis gantry machine at EMO is representative of the types of advances manufacturers can expect of Fidia technology. The machine offers a compact footprint while providing the flexibility to machine a range of materials from aluminum to steel and can be used for a variety of applications in aerospace, automotive and other market segments. The company is also partnering with leading robotics system integrator Reis Robotics which, among other things, will be working with Fidia to create new apps for Fidia CNCs.

Maniglio says the company is undergoing a rebranding to build upon what he feels is a solid basis and, in short, wants the industry to know that “Fidia is back.”

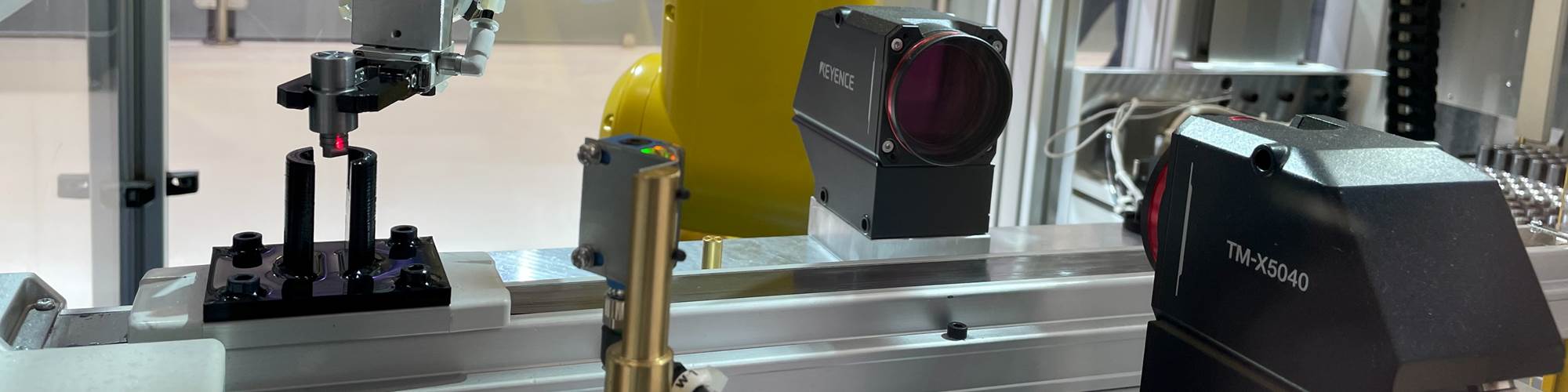

Rollomatic CEO Damien Wunderlin says the company’s Smart Factory cutting tool production concept achieves unattended manufacturing via machine communication and robotics.

-Rollomatic pushes for autonomous grinding in a “Smart Factory.” Rollomatic, which specializes in the design and manufacturing of precision CNC machines for cutting tools, continues to evolve its “Smart Factory” concept to automate tool production.

CEO Damien Wunderlin says the goal of its Smart Factory is to not only provide machines to create the tools, but to create a solution to handle and transport these tools between all different types of equipment. In short, this involves everything from feeding blanks into pallets to tool manufacture to final inspection without human involvement. This new approach entails the reorganization of production resources using information technology, machine communication systems and robotics.

In fact, Rollomatic has built a Smart Factory at its Customer Solution Center in Switzerland to both validate the concept and provide an example of a highly coordinated, self-contained workshop. This Smart Factory includes several key stages, such as tool blank handling using an Omron six-axis manipulator, preparation grinding of the blanks on a ShapeSmart NP50 five-axis cylindrical pinch/peel grinding machine, geometry grinding using a GrindSmart 630XW six-axis tool grinder as well as cleaning and measuring the finished tools. Notably, all transitions between these stages are managed by the Rollomatic SmartMoma mobile robot.

To establish a Smart Factory of this caliber, effective management and interconnection tools are imperative, the company says. Rollomatic has developed two communication systems specifically for this purpose. The first, known as RConnect, is designed to gather and organize machine data through the utilization of the OPC-UA protocol. The second, the RMonitor dashboard, offers a detailed overview of the machine fleet’s operational status. This equips operators with the means to logically and efficiently manage the available resources.

According to Rollomatic, enhancing machine autonomy through the automation of on-board measurement and compensation processes not only elevates the quality of the produced tools, but also yields substantial gains in productivity. For situations in which tool manufacturers would like to integrate in-process measurement — perhaps a device such as a Walter Helicheck 3D measuring machine — parts cleaners and dryers can be integrated into the production system.

That said, Rollomatic realizes that some customers already have equipment for cleaning, measuring, etching and so on. Therefore, the company is working with EngRoTec, developer of robotic solutions, to help integrate equipment of different brands into the Smart Factory concept. In fact, Rollomatic is working with three customers to implement this with the goal of them using their smart processes in real production scenarios by next year.

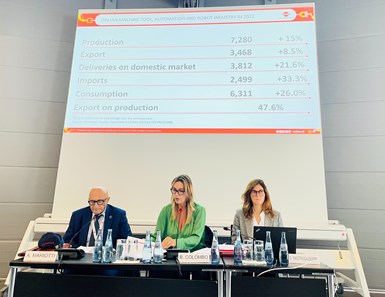

Per Barbara Colombo (center), president of UCIMU-Sistemi Per Produrre, says Italian machine tool builders are hoping to grow their businesses in countries such as Germany and the United States.

-Italian machine tool builders are looking abroad. In 2022, the Italian production of machine tools, robots and automation systems set new records for all main indicators. Production grew to more than 7 billion euros, (15% increase), consumption to 6.3 billion euros (26% increase) and exports to 3.5 billion euros (8.5% increase).

Barbara Colombo, president of UCIMU-Sistemi Per Produrre, notes that while export numbers for Italian machine tool manufacturers are increasing, those companies are hoping to grow their businesses overseas even more. Key countries they are eyeing include the United States and Germany. Sales to those countries were up 26.7% and 23.4%, respectively.

Colombo also notes that EMO is vital to Italian equipment providers proven by 197 Italian companies exhibiting. “Participating in EMO, cradle and heart of the manufacturing industry, is even more important today than in the past,” she explains. “This is because the reorganizing of value chains and their shortening due to the geopolitical instability we are currently experiencing clearly made the markets more interesting and rich in opportunities. These markets, such as Germany, France, Poland and Turkey, will certainly be well represented among visitors.”

She also points to the value of the upcoming 34th edition of BI-MU to be held October 9-12 next year. The 2024 show will have eight themes related to topics such as robotics, digitalization, composites, metrology, additive manufacturing, heat treatment and more. The show is held at the Fieramilano Rho in Milan.

What about that Sixth Article?

I also wrote the cover story for the EMO Daily third edition. The title was “Automation is More than Robots.” If you’ve read my columns and articles here in Production Machining before, you likely know about which I was preaching, so I don’t have to rehash it here…

RELATED CONTENT

-

CNC Machine Shop Employment Positions to Consider Beyond Machine Operators

Many machine shops have open machine operator positions to fill. But does it make sense for shops to also seek automation engineers, IT managers and assembly personnel?

-

Robotic Automation Options for Vertical Turning Centers

Custom robotic machine tending systems designed for specific high-volume machining applications can yield significant productivity and product flow benefits.

-

The Advantages of Automated Shopfloor Gaging

This “parallel kinematic” gage offers the opportunity to automate and improve machining process control for shops endeavoring to move from sample inspection to 100% inspection.